Get an overview of our bonds and ratings.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Get an overview of our bonds and ratings.

Bond Sales

Roadshows

There are currently no roadshows available.

Ratings

- Moody’s

- Aa1

- S&P

- AA

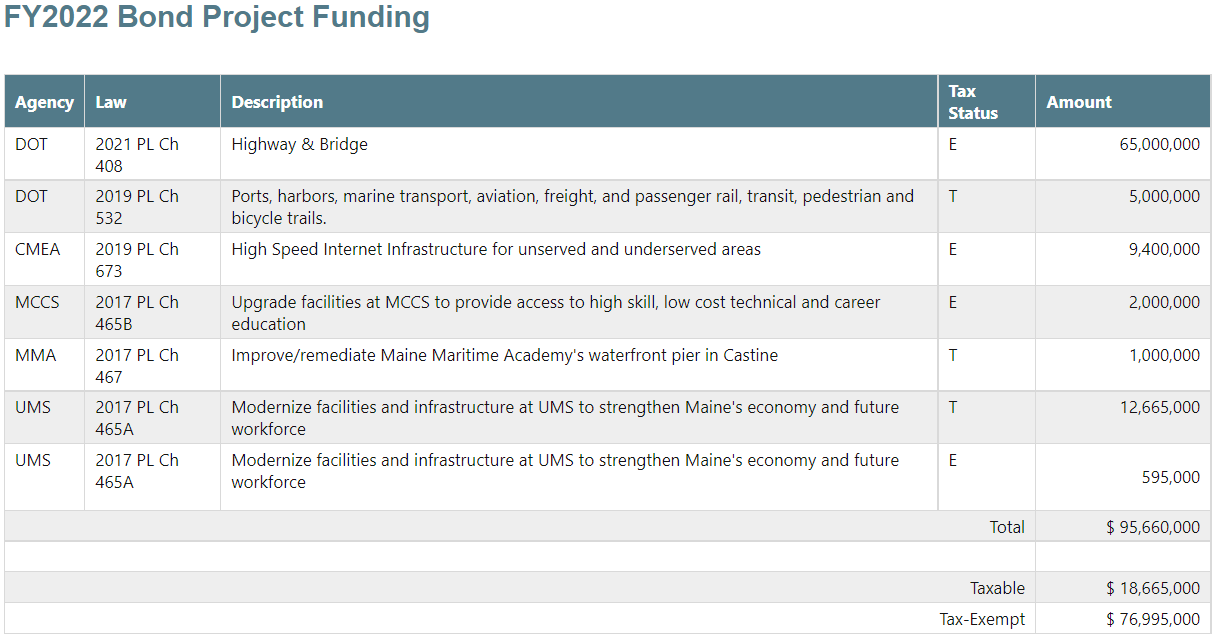

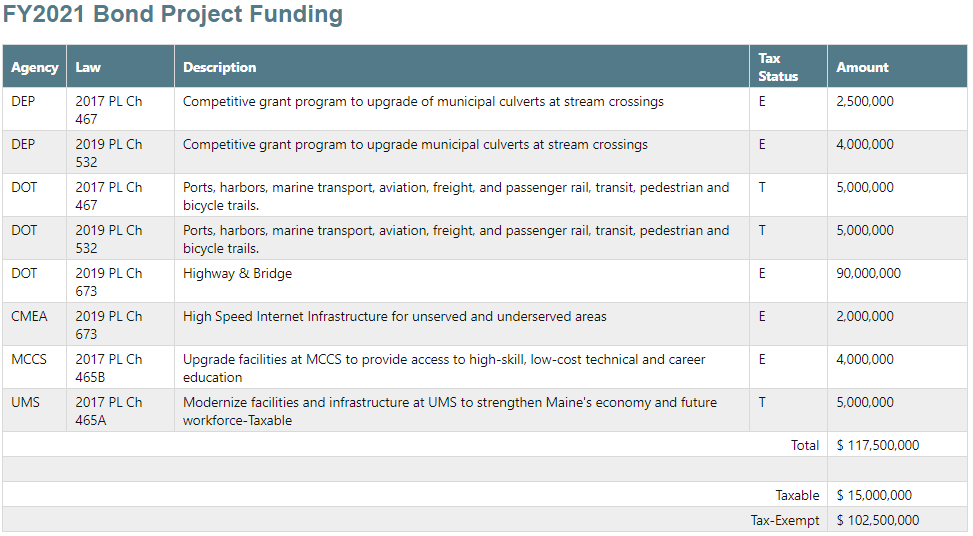

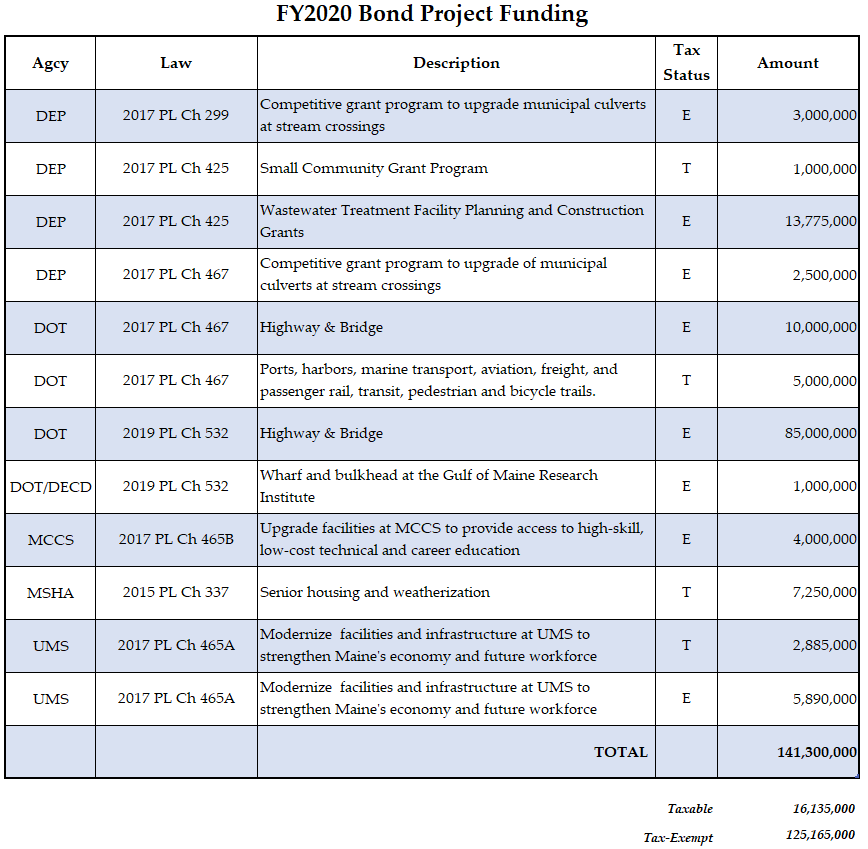

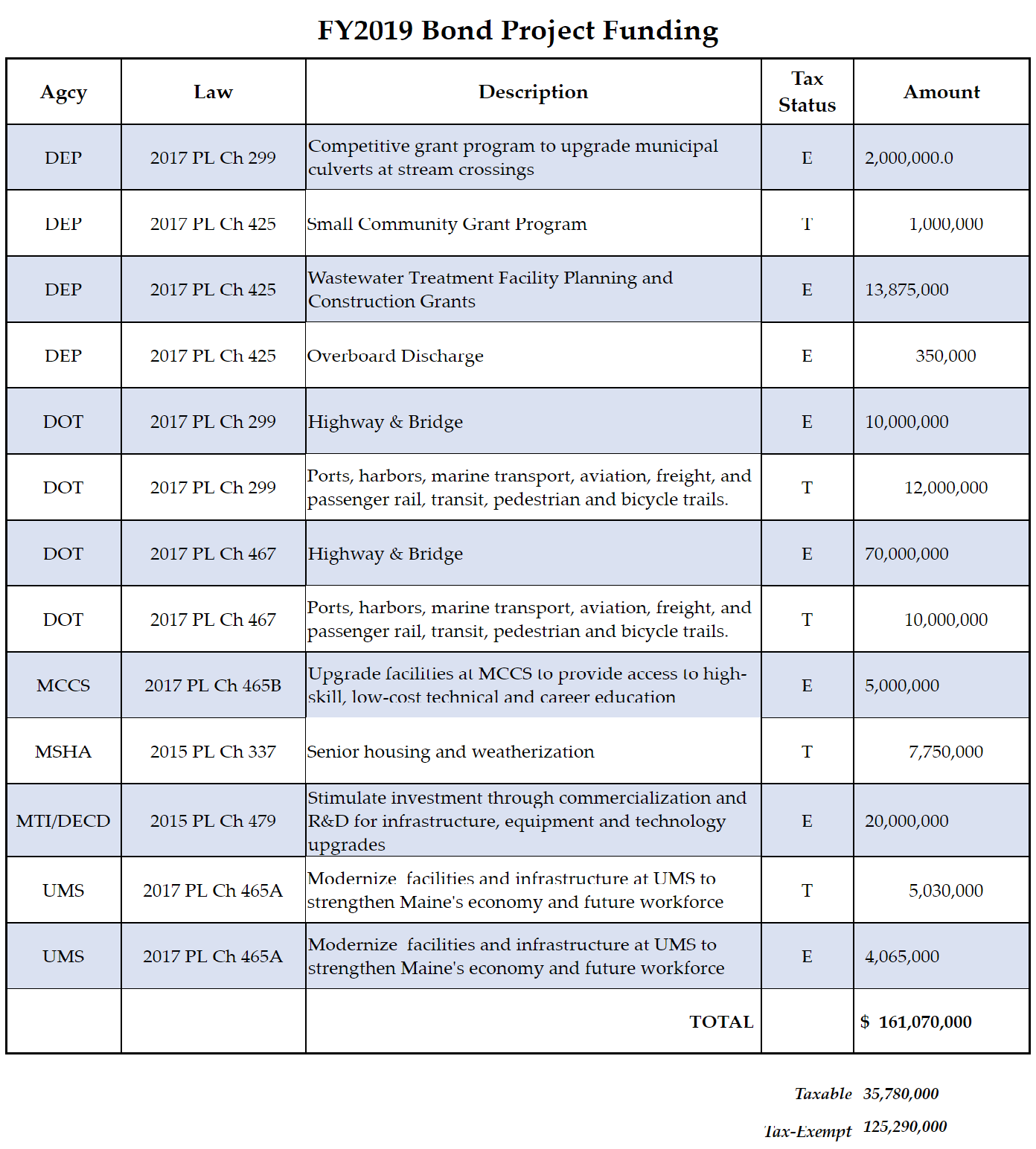

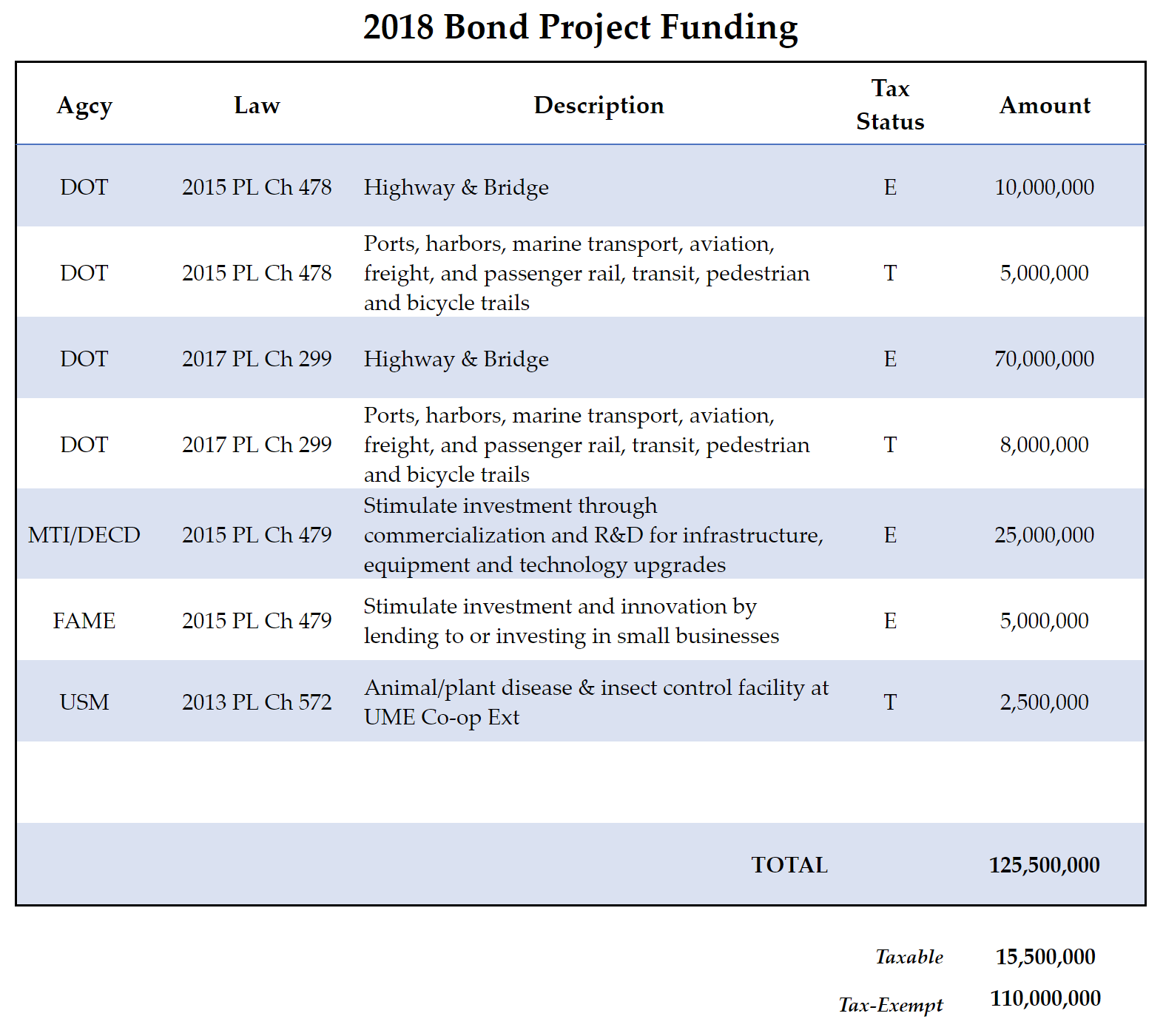

Bond Project Funding

State Bond Process

Paying for large capital improvements over time is possible through General Obligation (GO) Bonds. This long-term financing promotes jobs, education, infrastructure, economic development, energy efficiency, water quality, open space, and other public purposes. It achieves public goals approved by the Legislature and Maine voters. The process spreads financial responsibility for long-term investments over the time and population that can expect to enjoy the benefits.

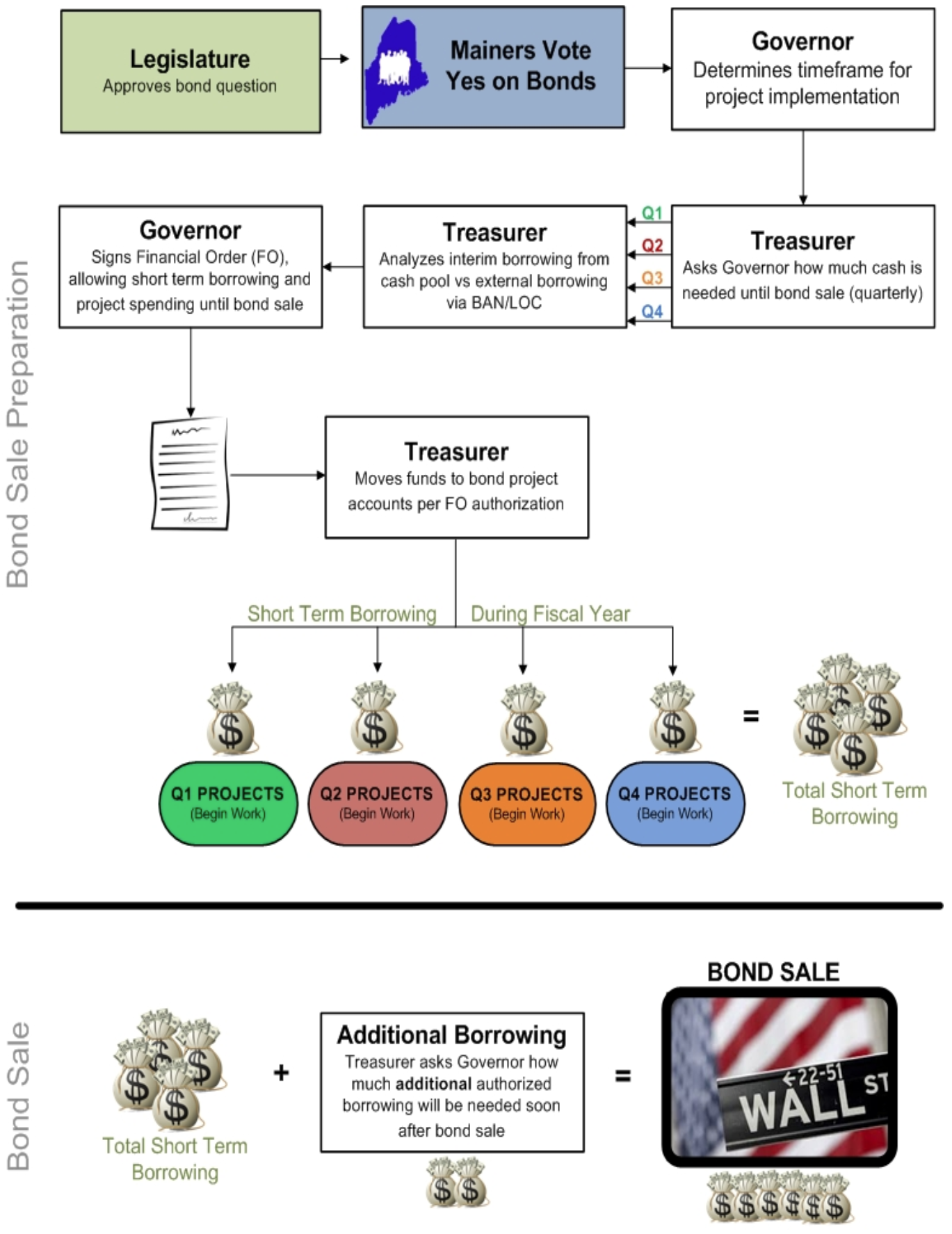

Following are steps taken in the General Obligation Bond Process.

- GO bonds require 2/3 vote of both Houses of the Legislature and a majority of voters.*

- Once approved, they become Authorized but Unissued GO bonds (AUB).

- Governor/executive agencies determine timing of borrowing for project implementation.

- Treasurer asks how much cash is needed in each Quarter until the final bond sale.

- With Bond Counsel, Treasurer determines taxable v tax-exempt projects.

- Treasurer asks Budget to set up accounts for each project, taxable & tax-exempt.

- Treasurer reviews and analyzes best short-term funding until final bond sale: internal borrowing from cash pool; external Bond Anticipation Note, loan or Line of Credit.

- Governor signs Financial Order/s for short-term funding of bond projects by quarter.

- Treasurer transfers funds to specific bond projects/accounts as requested by quarter. Short-term funding starts bond projects until most funds will be spent.

- Treasurer prepares a timeline/schedule for issuing the bonds, usually near the end of the State fiscal year June 30th. Bonds are not sold, funds are not borrowed until needed.

- Treasurer plans for consolidation of bond project debt into one GO bond package for tax-exempt, one for taxable projects.

- Treasurer engages rating agencies to rate the GO bonds.

- A Preliminary Official Statement containing 200 pages or more of State financial information is drafted and revised by those with specific knowledge of areas such as Financial Management, Budget, Revenues, Expenditures.

- An annual Information Statement for current bond holders is prepared annually before the end of the State fiscal year on June 30th if no bonds are sold.**

- Meetings are scheduled: Treasurer, Deputy Treasurer, DAFS Commissioner, Associate DAFS Commissioner, and Controller prepare rating agency presentations.

- The Treasurer, Deputy Treasurer, Commissioner of DAFS, Controller, Budget Office, and Commissioners of relevant agencies (or a subset thereof) make a formal presentation to Rating Agencies and answer questions.

- For a competitive sale, the State Treasurer and Deputy Treasurer work with a contracted Financial Advisor to price and sell the bonds via competitive bid process.

- For a negotiated sale, a bond underwriter, the senior manager, is selected along with other co-managers who market and sell the bond series.

- The bonds are structured and priced in the Municipal Bond market.

- The Official Statement is completed and printed.

- The bonds are sold, the sale is closed, and the bonds are delivered to the buyers, the funds to the issuer, the State of Maine.

Here are some additional facts about Maine General Obligation Bonds:

- Maine GO bonds are traditionally structured to mature in 10 years, with two payments per year after the initial borrowing.

- Voter authorization expires after five years; the Legislature then has two years to vote to reauthorize the bond for a period of up to five years.

- GO bonds are issued by the State Treasurer with the full faith and credit of the State.

- The State Treasurer has constitutional power to pay debt first out of revenues.*

- Maine’s Constitution prohibits using bonds to pay for current operations.*

*Constitutional provisions are from Art V, Pt 3, Sec 5 and Art IX, Sec 14.

**Required by bond covenants.

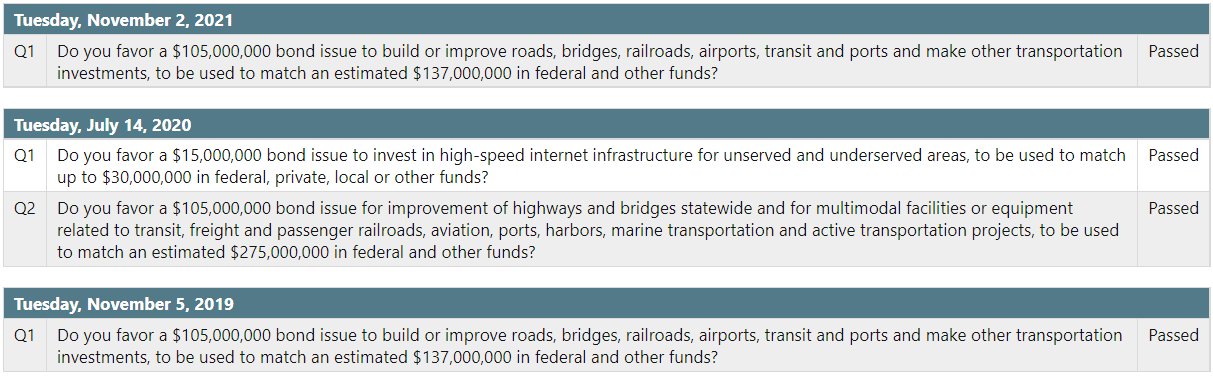

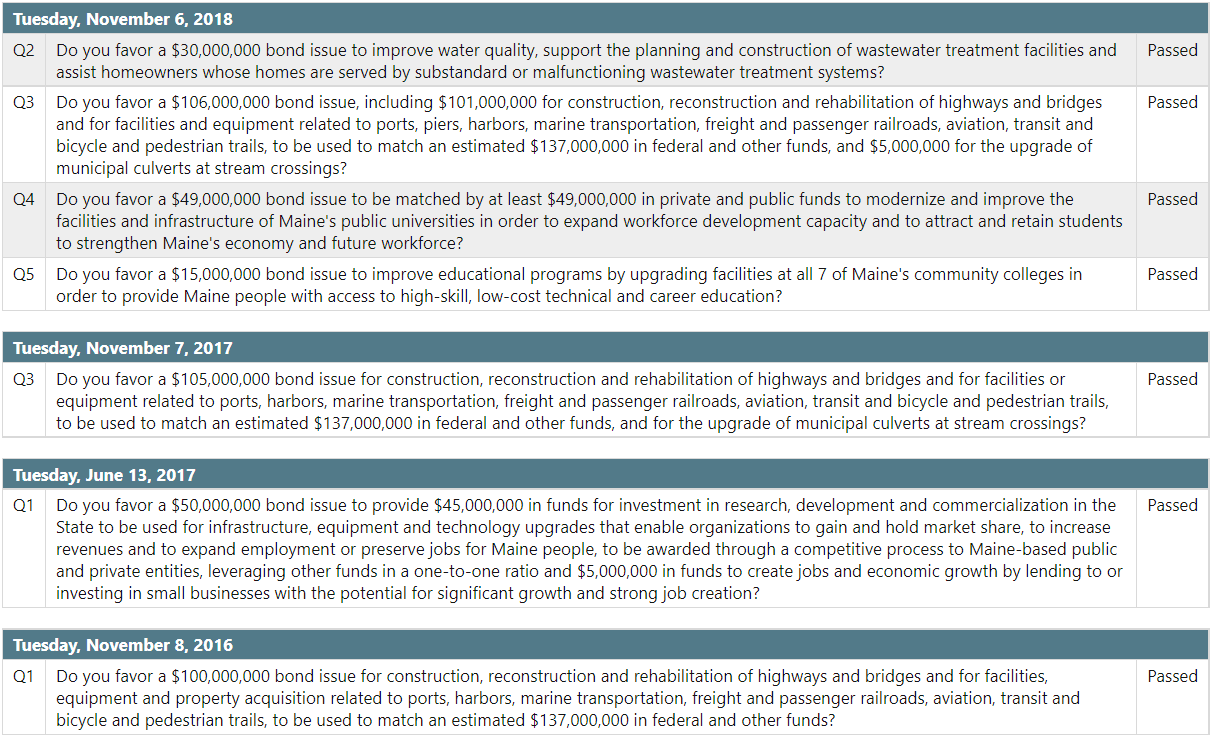

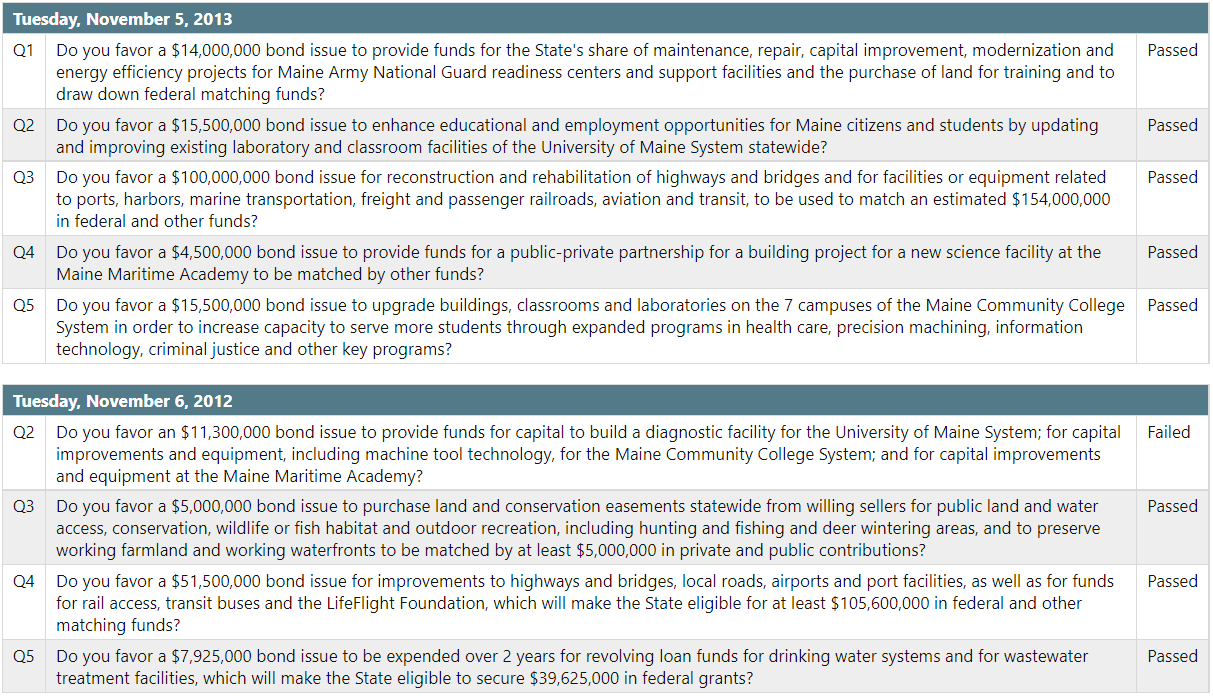

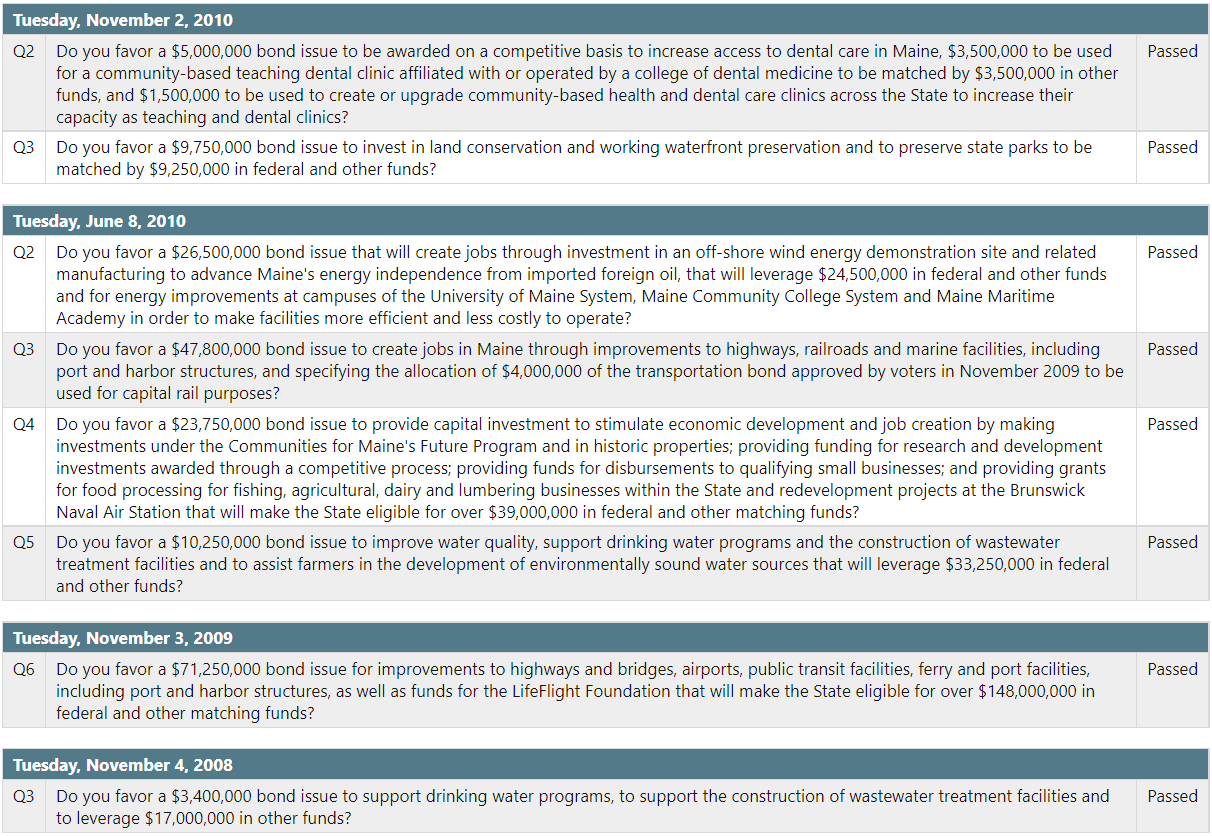

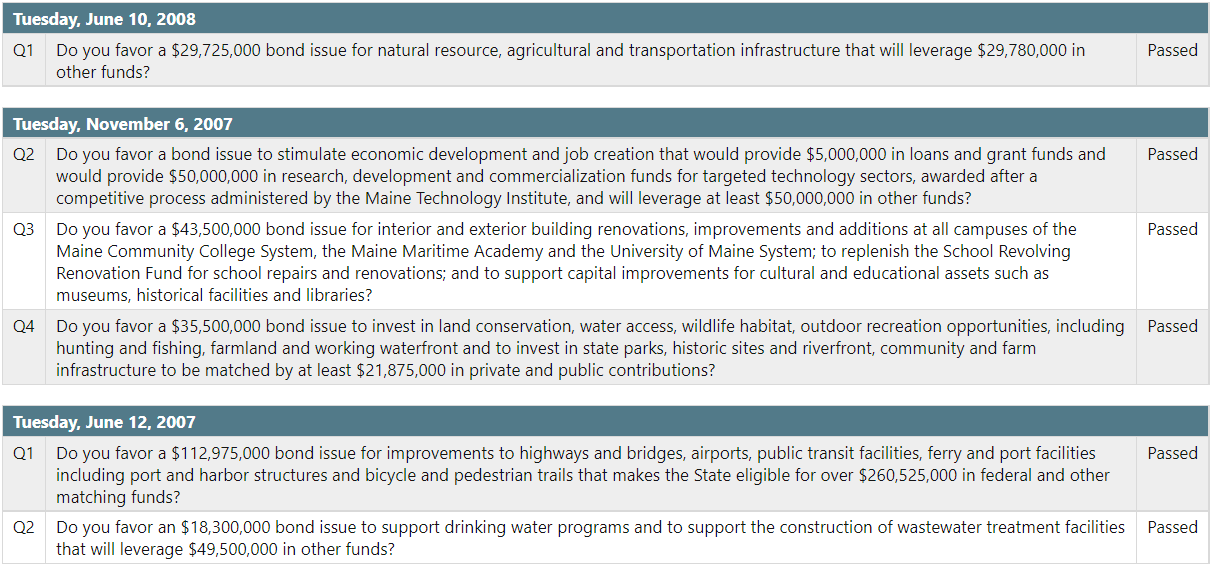

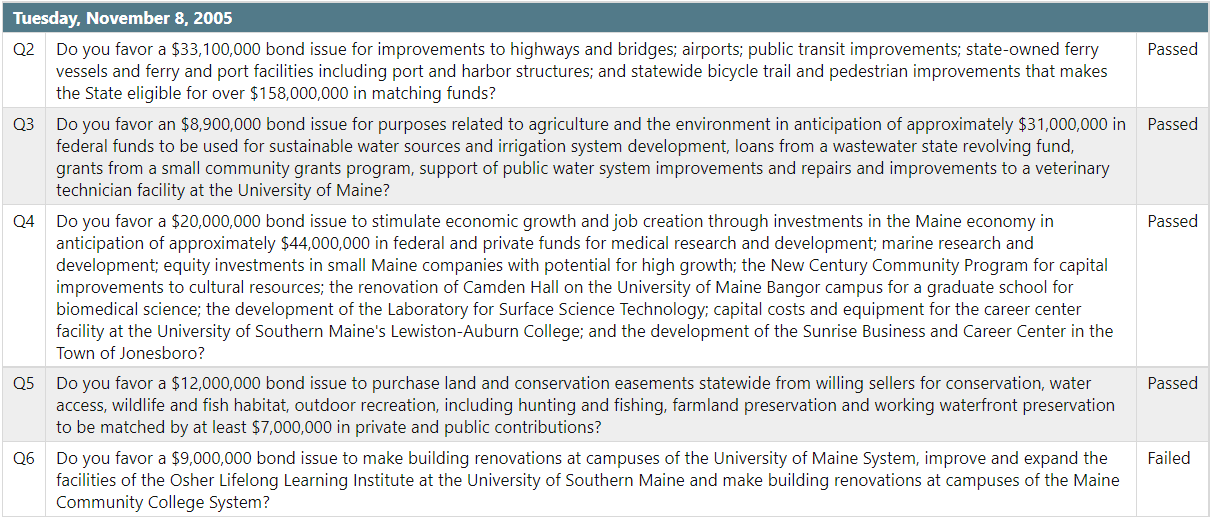

Bonds on the Ballot

Borrowing proposals are brought to the legislature.

The Legislature selects and the Governor approves projects they believe should be funded from money borrowed through general obligation (G.O.) bonds.

A statewide election is held to authorize or reject the bond proposals. http://www.maine.gov/sos/cec/elec/upcoming/index.html

Questions for the Referendum Election

When bond issues are on a referendum ballot, the Treasurer of State prepares a statement summarizing the total amount of State bonds that are outstanding and unpaid, the total amount of State bonds authorized and unissued, and the total amount of State bonds to be issued if ratified by the voters.

Click here to view the Treasurer’s Statement November 2021 (MS Word)